Introduction to Insurance Knowledge

Introduction to Insurance Knowledge

Navigating the complexities of insurance billing and coverage can often seem daunting for substance abuse and mental health facilities. As providers, understanding the nuances of various insurance policies is crucial for seamless operational management and guaranteeing that clients receive the care they deserve without financial hindrance. This blog aims to demystify the labyrinth of insurance terms, benefits, and claims processes. By enhancing your insurance knowledge, you can focus more on providing top-notch mental health services, confident that the administrative aspects are handled efficiently and correctly. Suppose you’re grappling with the details of billing codes or the specifics of patient eligibility. In that case, this post is designed to help your facility with the necessary insights to manage insurance interactions with poise and professionalism.

What is Risk?

Risk means a situation involving exposure to danger, harm, or loss

Risk in terms of insurance = the possibility of financial loss

Why is Risk Important to Insurance?

Risk is what makes you decide whether or not you need insurance.

Risk is the key factor that insurance companies consider when deciding whether to provide you with insurance and how much it will cost. The higher the risk, the more you’re likely to pay for insurance. This is why understanding and managing risk is crucial for insurance interactions.

How do We Handle Risk?

Avoidance: Choosing not to participate in an activity because of the risk involved. E.g., choosing not to golf in a lightning storm.

Retention: Saving resources in case of future loss. E.g., storing food in preparation for a hurricane or putting money away in savings

Transfer: Passing the risk on to someone else. E.g., Paying a monthly premium for an insurance policy and expecting the insurance company to protect your assets

What is Insurance?

Insurance – a legal contract that guarantees compensation for specified loss, damage, illness, or death in return for payment of a premium

Policyholder – a person who pays premiums to own an insurance policy and has the privilege to exercise the rights stated in the insurance policy; also called insured, patient, subscriber

Beneficiary – the covered entity of an insurance policy. The one who receives the benefit. Could be policyholders or dependents

Primary Parties

Patient – In substance abuse & mental health, referred to as ‘Client’. Receives services from providers for medical, mental, & addiction-related issues. Also called insured, policyholder, dependent.

Provider – A healthcare professional or facility that provides preventative, curative, promotional, or rehabilitative services to patients.

Payor – An insurance company, the responsible party for paying claims submitted by the provider for services rendered to the patient

How Does Insurance Work?

Suppose there are 100 people in a group

1%

With a 1% chance that one of them could get sick and require $10,000 in medical care

?

With a 1% chance that one of them could get sick and require $10,000 in medical care

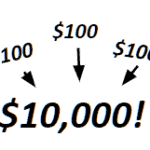

If each person pays $100 into a “pool” they will collectively have $10,000 to cover the medical costs of the person who gets sick.

</= $100

So, everyone gives up $100, but never loses more than $100

Law of Large Numbers – As the number of policyholders increases, the insurance company is more confident that its prediction will prove true. Therefore, insurance companies attempt to acquire many similar policyholders who all contribute to a fund that will pay the losses.

For example, the insurance company may know that, on average, two out of 100 homes will burn in a given year, but it will be much more confident in this prediction if it insures 1,000 homes— even more confident if it insures 100,000 homes. The more chances you get, the more likely you will achieve the desired outcome.

Types of Insurance

- Commercial Insurance – provided by private insurance companies through employers or the exchange.

- Government Insurance – provided by the government generally to cover a small portion of the population (veterans, the elderly, or low-income persons)

For our purposes, we will primarily be concerned with commercial insurance.

- Health – covers medical expenses due to diseases and accidents

- Homeowners – covers losses caused by fire, water damage, storm, theft, and other perils

- Auto insurance – covers car-related financial losses

- Life insurance – pays out a sum of money either at the death of the insured person or after a set period

For our purposes, we will look at health insurance coverage

Components of an insurance policy

Policy – the contract; specifies what risks are covered and how much will be paid for losses

Coverage – the risk covered and the amount of money paid for losses under an insurance policy

Premium – money paid to an insurance company to purchase a policy

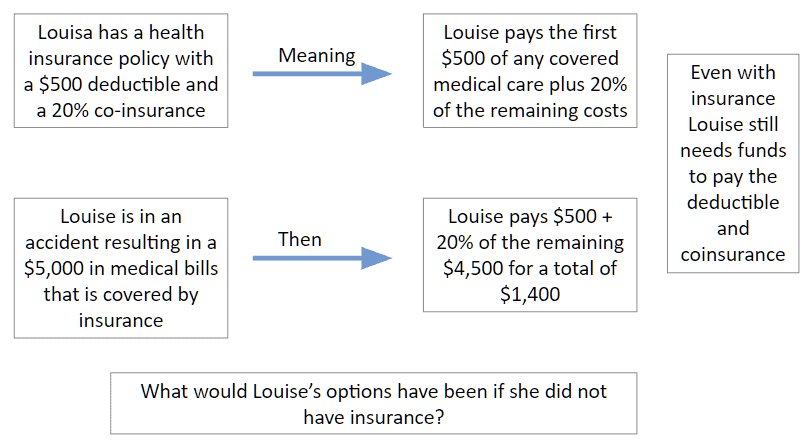

Deductible – a specified amount of money that the insured must pay before an insurance company will pay a claim

Co-pay – a payment made by a beneficiary (especially for health services) in addition to that made by an insurer

Co-insurance – the shared payment the insured pays against a claim

Limitations – the maximum amount of benefit (in dollars, days, or covered services) that the insurance company will pay.

E.g., A policy with limits of $1,000,000/$3,000,000 will provide a maximum of $1M per claim and $3M for all claims during a policy term

Exclusions – anything that is specifically not covered by your insurance policy and is outlined in the Exclusions section of your plan

For example, some insurance policies may not cover sub-acute residential detox.

Accreditations Requirements – some insurance companies require the provider to be accredited by a third party to ensure quality of service and compliance for services to be covered & reimbursed (e.g., The Joint Commission, CARF)

Assignment of Benefits – Abbreviated ‘AOB’ stipulates which party (patient or provider) will be paid when the payor (insurance company) pays a claim.

Authorization Requirements – often times, services require authorization from the insurance company before the patient can be treated and claims reimbursed. A Utilization Review department (abbreviated “UR”), also called Utilization Management (abbreviated “UM”), will call the insurance company to obtain authorized time (meaning, authorized services and/or days).

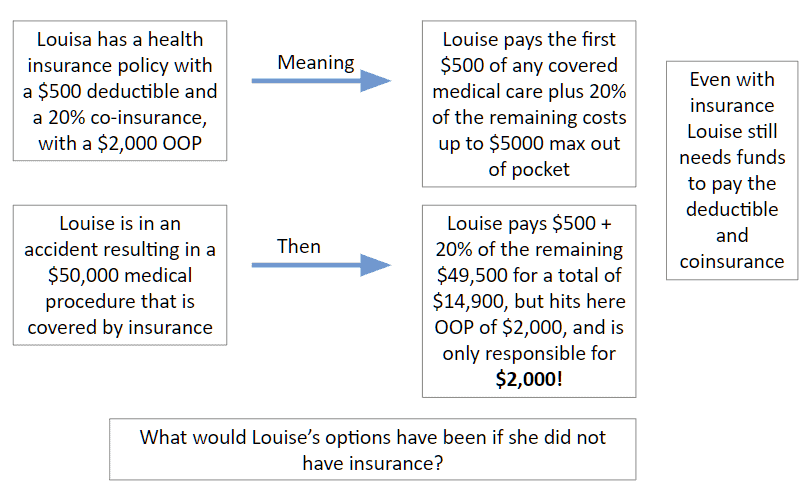

Using the same example, say Louisa had $50,000 in medical bills.

What would Louisa’s responsibility be?

$50,000 in bills

– $500 deductible

$49,500 remaining

20% co-insurance x $49,500 remaining = $9,900

Louisa’s responsibility = $500 deductible + $9,900 = $10,400!

To keep Louisa’s responsibility affordable, insurance has something called Maximum Out of Pocket (usually expressed as OOP Max); once Louisa reaches her OOP Max, insurance covers the remaining of her bills 🡨 see slide #19 (Billed and allowable amounts)

See Below

Out of Pocket Max (OOP) Example

Billed and Allowed Amounts

The difference between the billed amount and the allowed amount is vital to understanding what the provider will be reimbursed and what the patient will be responsible for paying.

- Billed Amount – the amount the provider bills the insurance for services rendered

- Allowed Amount – the maximum reimbursement the insurance company allows for a specific service. Varies across states and providers.

Allowable Amount may be established by:

- A fee negotiated with participating providers (in-network)

- An allowance established by law

- An amount set on a “fee schedule”

- An “Usual and Customary” amount per service type in the geographic location where the service is rendered

Providers often accept the allowed amount and do not bill patients for any remainder.

Using Louisa’s example, with $50,000 in medical bills and $2,000 in patient responsibility, insurance determines the amount of $30,000 that is allowed by the provider.

$50,000 in bills

-$2,000 paid by Louisa

-$30,000 allowed (paid) by insurance

$18,000 remaining

Providers may “balance bill” the patient for the remainder or write this amount off as a loss.

Health Maintenance Organization

Health Maintenance Organization (HMO) – you pick one primary care physician. All your health care services go through that doctor. That means you need a referral before seeing any other healthcare professional, except in an emergency. Visits to healthcare professionals outside your network typically aren’t covered by your insurance.

For example, you won’t go straight to a dermatologist if you get a skin rash. You would first go to your primary care physician, who‘d examine you. If your primary care physician can’t help you, he or she will refer you to a trusted dermatologist in your network who will.

One exception to this is that women don’t need a referral to see an obstetrician/gynecologist or OB/GYN in their network for routine services such as Pap tests, annual well-woman visits, and obstetrical care.

Coordinating all your health care through your primary care physician means less paperwork and lower health care costs for everyone.

Preferred Provider Organization (PPO) – also called Point of Service (POS), PPO plans give you flexibility. You don’t need a primary care physician. You can go to any healthcare professional you want without a referral—inside or outside of your network.

Staying inside your network means smaller copays and full coverage. If you choose to go outside your network, you’ll have higher out-of-pocket costs and not all services may be covered.

Exclusive Provider Organization (EPO)—EPO plans combine the flexibility of PPO plans with the cost savings of HMO plans. You won’t need to choose a primary care physician and don’t need referrals to see a specialist.

However, you’ll have a limited network of doctors and hospitals, and EPO plans don’t cover care outside your network unless it’s an emergency.

It’s important to know who participates in your EPO plan’s network. You’ll pay all costs if you go to a doctor or hospital that doesn’t accept your plan.

Key Legislation – Parity Act

Parity Act

- If health insurance coverages include medical/surgical benefits and mental health/substance abuse benefits, the financial requirements must be the same (i.e., deductibles & co-payments, etc.), and treatment limitations must be no more restrictive (i.e., day and dollar maximum limitations)

- https://aspe.hhs.gov/report/affordable-care-act-expands-mental-health-and-substance-use-disorder-benefits-and-federal-parity-protections-62-million-americans

Why is this important?

Because insurance coverage for substance abuse and mental health must be the same as the health benefit (whereas before, they could charge more or limit it more than the medical/surgical benefit)

Key Legislation – Affordable Care Act

Affordable Care Act

- Provided one of the largest expansions of mental health and substance use disorder coverage in a generation. Beginning in 2014 under the law, all new small group and individual market plans will be required to cover ten Essential Health Benefit categories, including mental health and substance use disorder services. They will be required to cover them at parity with medical and surgical benefits.

- The Affordable Care Act builds on the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA, or the federal parity law), which requires group health plans and insurers that offer mental health and substance use disorder benefits to provide coverage that is comparable to coverage for general medical and surgical care.

- https://aspe.hhs.gov/report/affordable-care-act-expands-mental-health-and-substance-use-disorder-benefits-and-federal-parity-protections-62-million-americans

Pre-existing Conditions

- Under the Affordable Care Act, health insurance companies can’t refuse to cover you or charge you more just because you have a “pre-existing condition” — that is, a health problem you had before the date that new health coverage starts. They also can’t charge women more than men. These rules went into effect for plan years beginning on or after January 1, 2014.

Why is this important?

Insurance can no longer deny you care based on a previous diagnosis (substance abuse / mental health) or charge you more, and the substance abuse / mental benefit must be a covered benefit.

Mastering Insurance to Support Patient Care and Facility Stability

Navigating insurance for mental and substance abuse health facilities can be challenging. Still, with the right knowledge and strategies, it can also be managed effectively to ensure that the facility and its clients are safeguarded against undue financial risks. Providers must understand the types of insurance available, the components of insurance policies, and the legislative landscape that shapes how these policies are implemented. With this knowledge, facilities can make informed decisions that optimize their coverage and fulfill their crucial role in providing care.

Moreover, facilities should continuously educate about changes in insurance regulations and new healthcare laws to stay compliant and up-to-date with industry standards. Implementing a robust billing system and training staff to handle insurance claims proficiently can reduce errors, minimize claim rejections, and expedite payments. Facilities must also review their policy choices regularly to ensure they get the best possible coverage at the most reasonable cost, considering new options like cyber insurance to protect against digital risks.

Understanding the detailed nuances of insurance interactions, such as the implications of co-pays, deductibles, and co-insurance, can also significantly affect the facility’s financial health and the quality of service provided to clients. By effectively managing these aspects, facilities can avoid the pitfalls of underinsurance or costly over insurance.

Ultimately, the goal is to enhance the facility’s operational efficiency and ensure financial stability, enabling providers to continue offering essential mental health and substance abuse services to those in need. This commitment to fiscal responsibility and high-quality patient care will foster a stronger, more resilient healthcare system.